Specialty medications are driving the future of pharmaceutical innovation, accounting for nearly 75% of new drug approvals over the past five years. These medically transformative drugs, which are used to treat chronic, complex, and rare conditions, represent a growing and disproportionate share of U.S. drug spend. In 2024, specialty medications represented about 2% of all claims and accounted for nearly 20% of total health care spending in a commercially insured population of 9.7 million, according to an analysis by the Evernorth Research Institute.

The concentration of spending in a few high-cost drug categories with limited price competition – such as oncology, rare disease, and multiple sclerosis – remains a major driver of costs for all payers, said Jeremy Fredell, vice president of pharma trade relations for Express Scripts.

Biosimilars have emerged as a key enabler to expand patient choice and lower specialty medication costs, delivering meaningful savings to employers, public programs, and patients. Biologics – which include biosimilars – are derived from living organisms and often require special handling, storage, and administration. Each biosimilar is highly similar to and has no clinically meaningful differences from the U.S. Food and Drug Administration (FDA)-approved biologic, known as the reference or originator product.

The 2025 Pharmacy in Focus report demonstrates measurable savings to patients and the commercial health insurance market from biosimilars, tackles adoption issues facing stakeholders across the health care ecosystem, and explores solutions. The report is based on a comprehensive nationwide survey of consumers with employer-sponsored health benefits, employers, providers, pharmacists, and health plan leaders, along with an extensive analysis of claims data from 27.3 million commercially insured individuals and an evaluation of industry and scientific literature.

Our research on biosimilars identified the following key insights and strategic actions to address these concerns in 2025 and beyond.

1. Biosimilars are reshaping drug spend in the inflammatory conditions category, delivering real-world savings and bending the cost curve

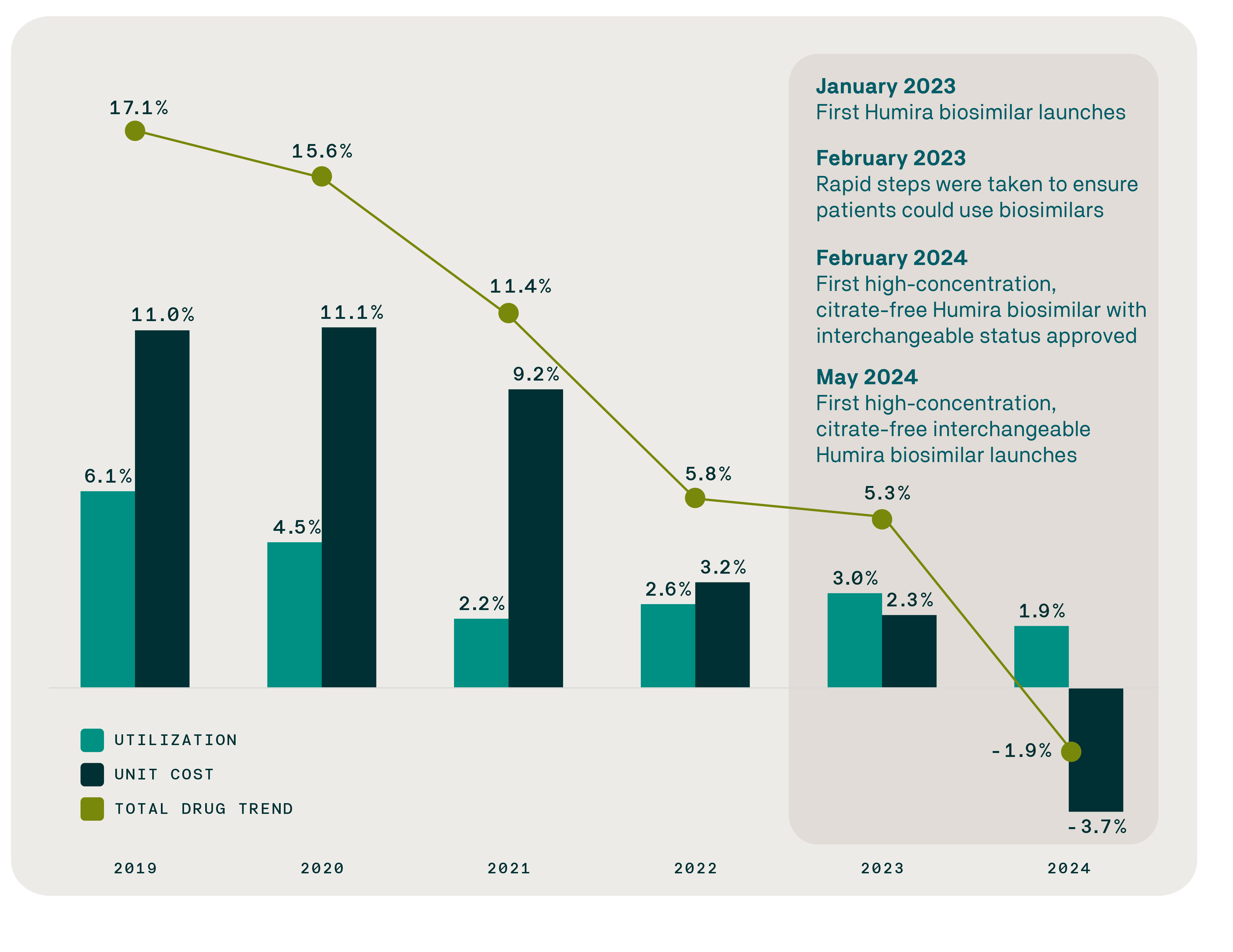

As of June 1, 2025, the FDA had approved 71 biosimilars for 19 originator biologics, and 53 biosimilars had launched across 14 reference products. Data from the Evernorth Research Institute shows the first sustained reversal in drug trend for inflammatory conditions in years despite a continued increase in utilization, evidence that biosimilars are delivering on their promise of real-world savings. In 2019, drug trend in the inflammatory conditions category increased by 17.1% over the previous year. In 2024, trend in that category fell by 1.9%, driven by unit cost reductions and despite a 1.9% increase in utilization.

While multiple factors influence drug spending, this shift closely aligns with the introduction of biosimilars for inflammatory conditions and new benefit strategies to increase biosimilar access and affordability.

Inflammatory conditions category drug trend declines as biosimilars gain traction

February 2024 marked the first FDA approval of a high-concentration, citrate-free, interchangeable biosimilar for Humira (adalimumab), a brand medication that treats multiple inflammatory conditions and which was the top-selling drug in the world for six consecutive years (2016-2021). The number of adalimumab biosimilar claims surged by 1,145% within months, growing from just 4.2% of claims in the first quarter of 2024 to 52.3% in the first quarter of 2025.

The Evernorth Research Institute analysis confirms that biosimilars for Humira have accelerated price competition and are delivering meaningful cost savings. From January 2024 through March 2025, biosimilars for Humira generated over $200 million in savings. In 2024 alone, savings from Humira biosimilars averaged $4,505 per patient per year (PPPY) – evidence that biosimilars are delivering on their promise of real-world savings.

2. The growing biosimilar pipeline offers a critical lever to expand treatment options, lower costs, and improve outcomes for patients and communities

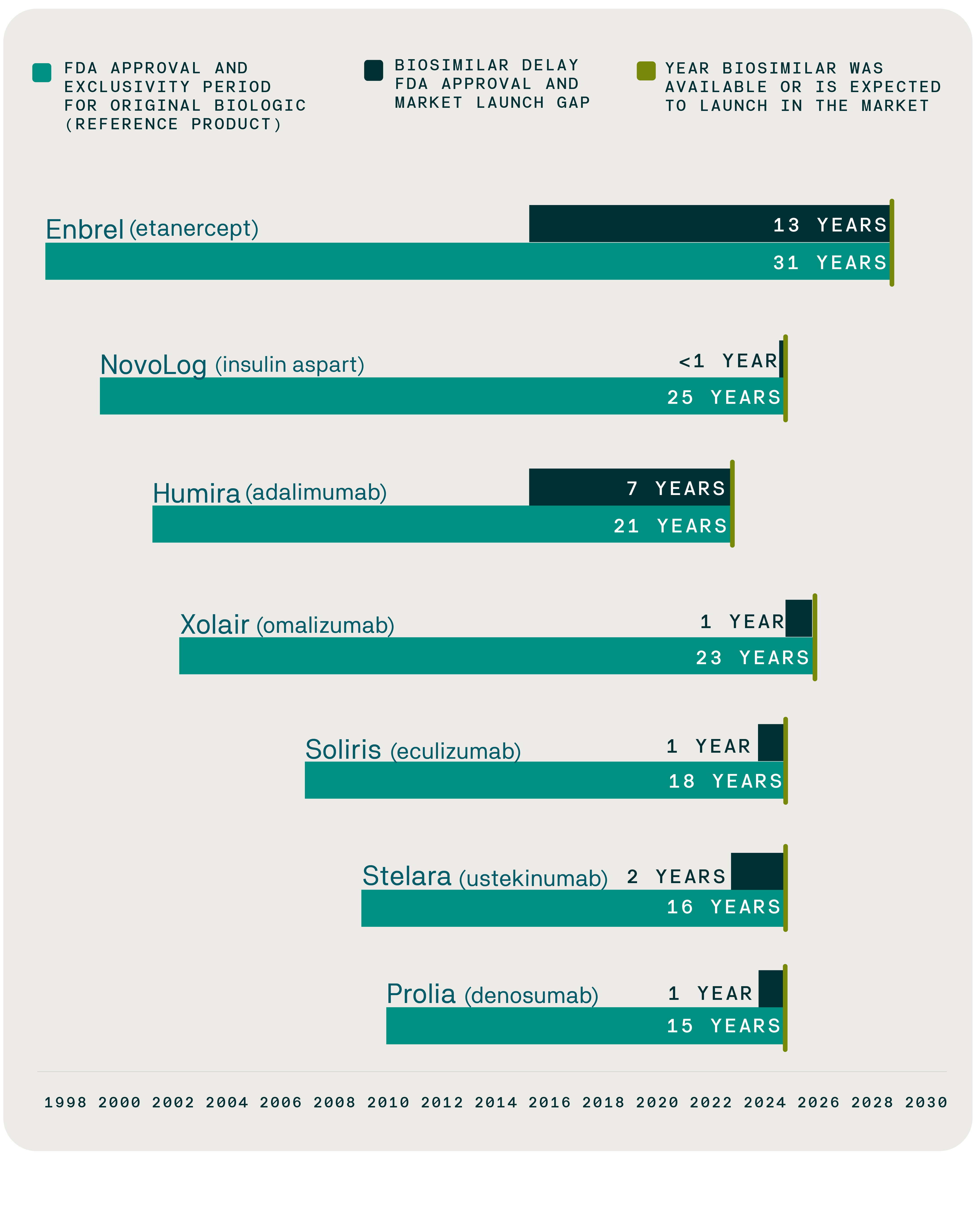

Enabling biosimilars and generics for high-cost products to enter the market as soon as FDA exclusivity and primary patents expire is essential to lowering prescription drug prices. However, manufacturers of brand-name biologics seek to limit competition and defer cost savings by utilizing excessive patent protections and exclusivity periods to delay access to biosimilars and generics for high-cost specialty drugs. A key example is the biosimilar for the rheumatoid arthritis treatment Enbrel, which won FDA approval in 2016 but is not expected to launch until 2029 – a 13-year delay. Another example is the generic for the blood thinner Eliquis, approved by the FDA in 2019, which is not expected to launch until 2028 – a nine-year delay.

Consequently, U.S. employers and public programs face billions in lost savings. For the cancer immunology biologic Keytruda alone, a five-year delay in access to a biosimilar could represent as much as $45.3 billion in lost savings for commercial health plans and their members. Public programs, including Medicare and Medicaid, also could see similar lost savings.

From approval to access: Mapping delays in biosimilar availability and reference product exclusivity

Over the next decade, 118 biologics are expected to lose patent protection, unlocking a significant opportunity for biosimilars to generate savings through increased competition. With more biosimilars becoming available, a survey conducted by the Evernorth Research Institute shows that employers and health plans are on board with these medications:

- 78% view biosimilars as tools to lower costs for their organizations.

- 79% view biosimilars as tools to lower costs for employees.

- 70% say their organization is working to add more biosimilars to their formularies.

Shortening the time from biosimilar approval to market access must remain a top priority if we are to fully realize their promise, Fredell said. “Improving the FDA biosimilar approval process so that all biosimilars are designated as interchangeable is an important step toward access and affordability. Another key step is preventing improper patent litigation from delaying access to generics and biosimilars beyond primary patent expirations.”

3. Gaps in patient experiences and provider concerns can influence biosimilar adoption, highlighting the need to improve these areas

Only 31% of patients living with a chronic condition are aware of biosimilars, according to Evernorth Research Institute survey data, as are 64% of health care providers. This awareness gap underscores the crucial role providers play in introducing biosimilars and educating patients about this therapeutic option. Sustaining biosimilar adoption will require strengthening education, building trust, and ensuring that patients and providers feel confident navigating this new era of treatment options.

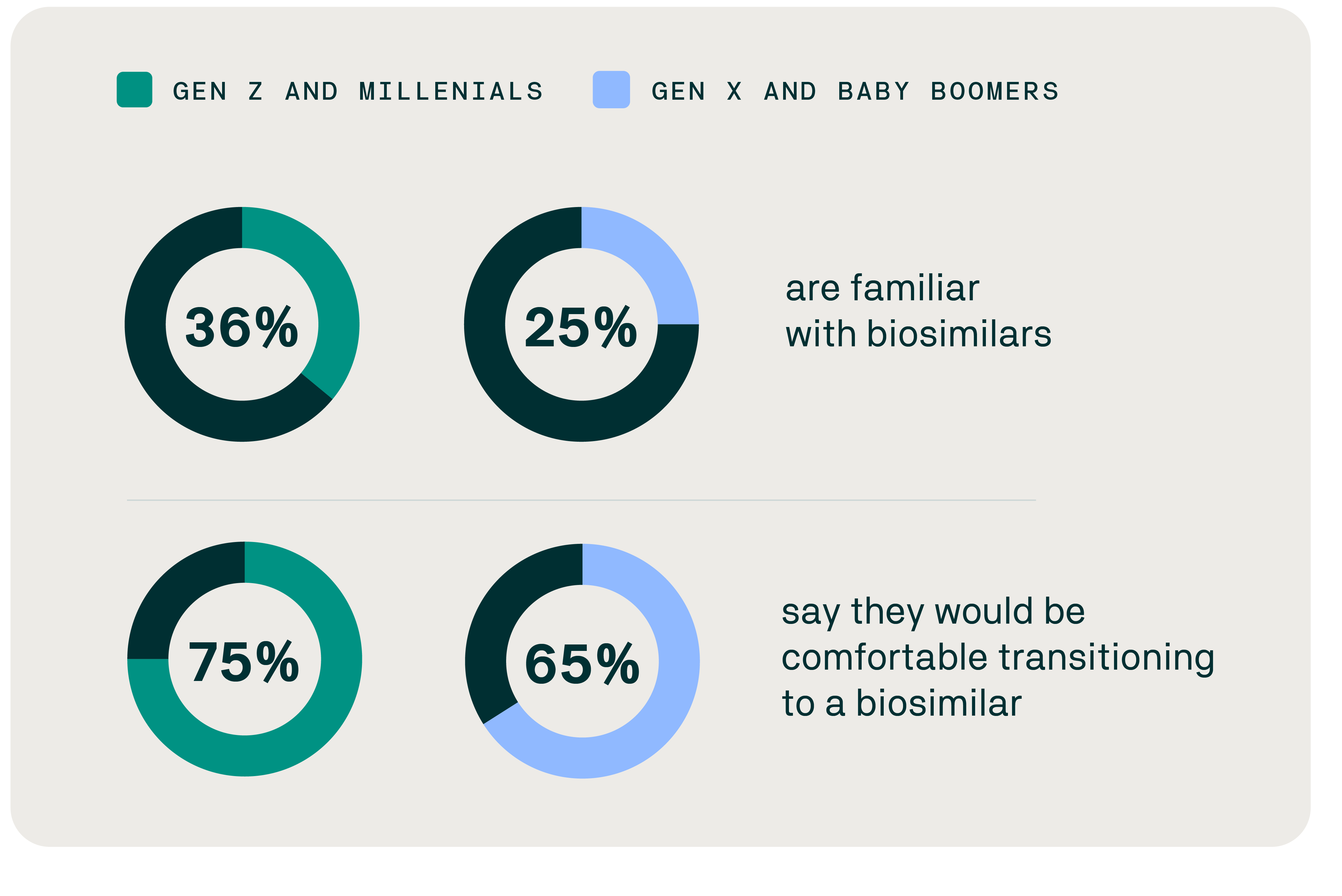

Awareness and openness to biosimilars by generation

Evernorth research has found that younger people are the most likely to be aware of biosimilars and would be more comfortable transitioning to a biosimilar. Despite their strong interest, however, pharmacy trends data in the inflammatory category shows that the biosimilar utilization trend for Gen Z and millennials lags far behind Gen X and baby boomers. This may be due to several factors, including provider prescribing patterns, patient preferences, and experiences with the health care system.

Strategic actions: Unlocking long-term value through patient-centered system transformation

The promise of biosimilars is no longer theoretical – it’s unfolding. To fully realize the potential of biosimilars as catalysts for a more sustainable health care system, stakeholders should align on three strategic fronts:

Promote evidence-based assessments. Expanding real-world evaluation efforts that measure biosimilar value across costs, outcomes, and community benefits could fuel smarter, value-based decisions.

Accelerate biosimilar adoption with purpose by addressing practices that delay biosimilars, optimizing formularies, and educating patients and providers about biosimilars.

Drive systemic transformation through trust-centered design. Prioritizing investments in tailored patient and provider education, shared decision-making support, and trust-building strategies are foundational to a sustainable health care system.

“As we’ve learned from Humira, a focus on removing systemic barriers that delay access to generics and biosimilars is essential to lowering prescription drug prices,” Fredell said.